Market Analysis Review

Daily Market Report: Expert Technical & Fundamental Insights – 21.11.2024

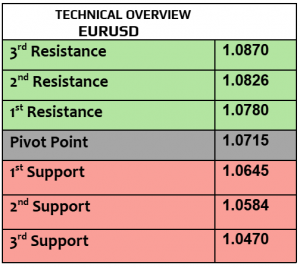

EURUSD

EURUSD was little changed today, trading at $1.0551. ECB financial stability report indicated that the rising global trade tensions may cause adverse economic shocks, at the same time the wages in EZ rose by 5.4% in Q3, the most since EUR was introduced, which means that more inflationary pressures are likely to happen. Consumer confidence from EZ will be released later today.

$1.0590 remained short-lived resistance then $1.0635, but price action showed no bullish bets. The correction in USD index may trigger further but slow correction to higher level.

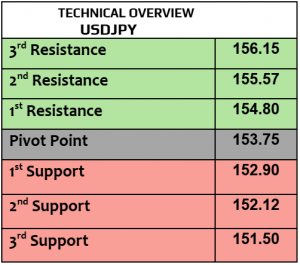

USDJPY

USDJPY slightly fell today & traded at 155.07, waiting for BoJ governor Ueda speech later today. Traders are likely to watch closely the national inflation from Japan later today, it is still at 2.5%, higher than the target of BoJ at 2%. The higher the inflation from Japan, the higher the probability of stronger Yen.

Our target at 155.60 was executed, 154.10 is support then 153.50, however the traders’ behavior shows less appetite to sell heavily. This currency pair might be exposed to BoJ intervention if Yen weakness persists.

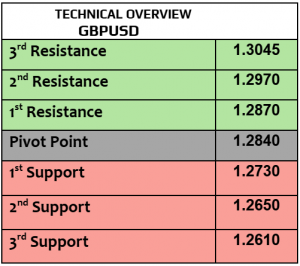

GBPUSD

What was the UK inflation in October? UK CPI increased by 2.3% last month, stronger than before 1.7% & higher than the estimates of 2.2%, so what does that really mean? It simply means that BoE mission to cut the rates became more complicated. In other words, UK is living the stagflation. If the geopolitical risks in EU intensify, then GBP will be under huge pressure.

$1.2624 & $1.26 are support levels, $1.2750 is resistance. While the behavior of the traders was not fully bearish, heading higher is likely to be slow.

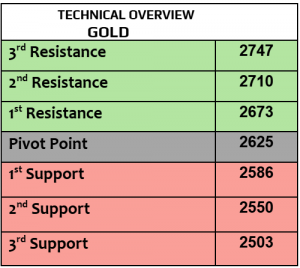

Gold

Gold traded slightly higher today at $2655 per ounce, even if USD index has not fallen. What happened in the last few days was mainly driven by the rising tensions between Russia & the West after Ukraine launched Western-supplied weapons on the Russian soil for two times. Remember that the escalation of the war may result in higher energy prices (oil & gas), that’s another reason to bet on higher inflation which is good for gold bulls.

Price action kept recovering, heading higher to $2612/$2620 (both targets are executed) then $2658. $2560 & $2540 are important support, if broken then no major support before $2510.

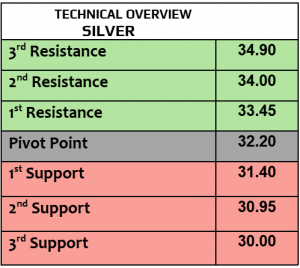

Silver

Silver gained & traded higher today at $31.15 per ounce. Silver is less exposed to the Fed monetary policy than gold, that’s why the markets will keep focusing on two main factors, China’s data & the consequences of Trump’s tariffs once approved. The demand for silver from EV industries is inevitable, however if trade war intensifies then the outlook demand for silver is likely to be questionable.

$30.20 and $29.75 are support levels, $31 remains short-term resistance (executed) then $31.75. Volatility is low.

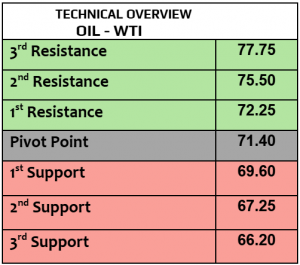

Oil – WTI

Even if the war between Russia & Ukraine intensified in the last few days, oil prices remained under pressure, WTI fell in the last two days amid tight volatility. WTI traded today at $68.93PB, Brent $72.94PB. According to EIA, US crude oil inventories increased by 0.5 million barrels, exceeding the expectations of 0.4 million barrels. The monthly performance of oil prices gave us an idea that the traders are still betting on Trump’s oil policies that may support more oil production in the US.

$70.50 is the next target. $67.60 & $66.90 are important support. Price action remained slow with tight volatility. 1H RSI is falling now.

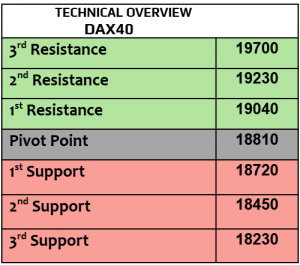

DAX

Germany was & still the most vulnerable country to ongoing war between Russia & Ukraine, so just think about more escalation, then the question will be how bad the impact on DAX index & markets’ sentiments in general. DAX futures traded higher today after little change on Wednesday, Mercedes fell -1.8%, BMW -0.8%, Siemens -0.72% and SAP gained 0.32%. PPI from Germany came in line with expectations at 0.2% in October, better than September of -0.5%.

Price action and markets’ sentiments were somehow mixed. 18900 is support (executed) then 18700 (still valid) , 19290 is resistance.

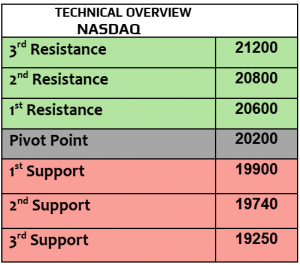

Nasdaq

Mixed performance in US equity indexes on Wednesday after Dow Jones gained 0.3%, SPX was flat & Nasdaq slightly fell by -0.11%. Nvidia’s earnings surpassed the quarterly expectations in Q3, while the markets were somehow busy with many Fed members comments, rising tensions in Europe & Trump’s new appointments. Weekly jobless claims, Philadelphia Fed manufacturing & many Fed members comments will be due later today.

Price action kept improving, heading higher to 20750. 20400 & 20300 are support for day-traders. 1H RSI shows the potential for further gains with slow volatility.

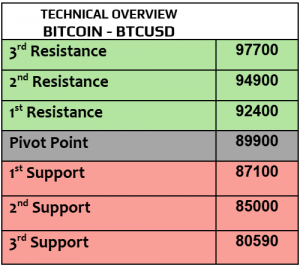

BTCUSD

Bitcoin climbed closer to $100K, with new historical record-high at $97700, Eth $3105, Cardano $0.7825 & XRP $1.11. Market’s mania continued & driven by the strong momentum of buyers amid news that Trump team weighs creating first ever White House crypto role.

Price action showed no appetite for profit taking, still heading higher to new resistance at $97700. $88900 & $86500 are support. Continuous strong volatility ahead. 1H RSI is approaching overbought level. Daily chart is already overbought.