Market Analysis Review

UK Manufacturing PMI hits 52.5, USDJPY gains 0.74% with 107.9 pips; Focus on Powell's speech

Previous Trading Day’s Events (22.08.2024)

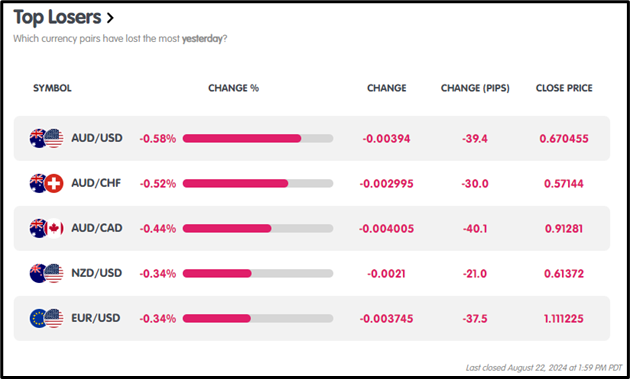

France PMI :

France’s Manufacturing PMI dropped to 42.1 in August from 44 in July, below expectations of 44.4, marking 19 months of contraction.

France Services PMI surged to 55.0, up from 50.1, exceeding forecasts of 50.3.

Germany PMI :

Germany’s Manufacturing PMI fell to 42.1 in August from 43.2, below the 43.5 forecast, marking 26 months of decline.

Germany Services PMI dipped to 51.4, down from 52.5, missing expectations of 52.3.

UK Services PMI:

UK Manufacturing PMI rose to 52.5 in August from 52.1, beating expectations of 52.1.

UK Services PMI increased to 53.3, exceeding forecasts of 52.8.

US Manufacturing PMI:

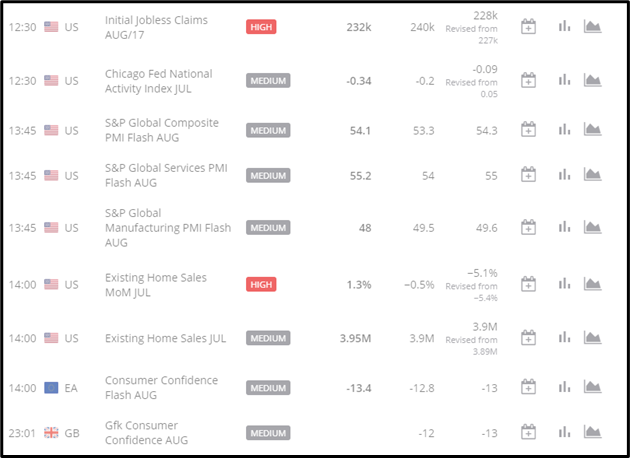

US Unemployment Claims rose by 4,000 to 232,000, surpassing the 230,000 forecast.

US Manufacturing PMI dropped to 48, missing expectations of 49.6, while US Services PMI edged to 55.2, beating the forecast of 54.

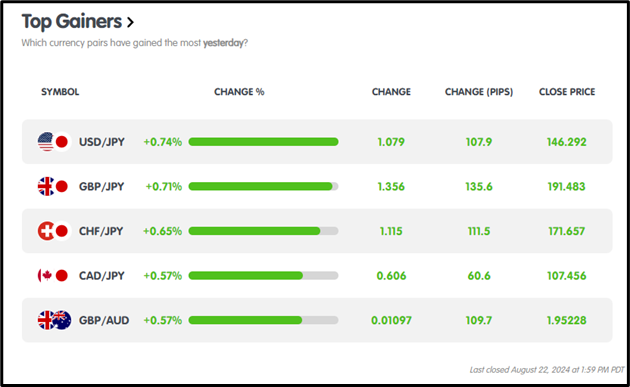

Winners Vs Losers In The Forex Market

On August 22, 2024, USDJPY led the forex market gains with a +0.74% shift, adding 107.9 pips, while AUD/USD posted the largest loss, dropping -0.58% with a decline of 39.4 pips.

News Reports Monitor – Previous Trading Day (22.08.2024)

Server Time / Timezone EEST (UTC+03:00)

- Tokyo Session: No major data.

- London Session: Bearish EUR at 7:15-7:30 am GMT as France and Germany Manufacturing PMIs fell below forecasts; Services PMIs mixed.

Bullish GBP at 8:30 am GMT as UK Manufacturing and Services PMIs exceeded expectations.

3. New York Session: Bearish USD at 12:30 pm GMT with unemployment claims rising above forecast.

Bullish USD at 1:45 pm GMT as US Services PMI beat estimates.

General Verdict:

FOREX MARKETS MONITOR

EURUSD (22.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

EURUSD exhibited a bearish trend, opening at 1.11447 and closing lower at 1.11102, with a daily high of 1.11645 and a low of 1.10964.

CRYPTO MARKETS MONITOR

CRYPTO MARKETS MONITOR

BTCUSD (22.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

BTCUSD experienced a bearish trend, opening at $61,224.99, and hitting a daily high of $61,529.75 before reversing to a low of $59,721.54, and closing lower at $60,635.80.

STOCKS MARKETS MONITOR

STOCKS MARKETS MONITOR

Alphabet (22.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Alphabet experienced a bearish session, opening at $167.22 and closing lower at $163.78. The stock hit an intraday low of $163.37, while the high for the day was $167.23.

INDICES MARKETS MONITOR

INDICES MARKETS MONITOR

US30 (22.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

The US30 experienced a bearish trend, opening at $40,931.13, reaching an intraday high of $41,070.41 before dipping to a low of $40,603.03, and ultimately closing lower at $40,767.08.

COMMODITIES MARKETS MONITOR

COMMODITIES MARKETS MONITOR

USOIL (22.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

USOIL maintained a bullish trend, opening at $71.816, reaching an intraday high of $73.322, dipping to a low of $71.395, and ultimately closing stronger at $72.799.

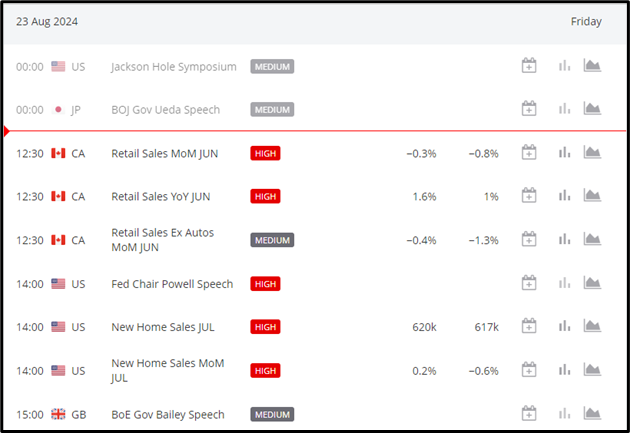

News Reports Monitor – Today Trading Day (23.08.2024)

- Tokyo Session: BOJ Gov Ueda Speech. Bullish JPY

- London Session: No significant data.

- New York Session:

CAD Retail Sales MoM: -0.3% forecast. CAD Strengthens if the actual is higher.

CAD Retail Sales YoY: 1.6% forecast. CAD Strengthens if the actual is higher.

CAD Retail Sales Ex Autos MoM: -0.4% forecast. CAD Strengthens if actual is higher.

US Fed Chair Powell Speech: High Impact expected.

US New Home Sales: 620k forecast. USD Strengthens if actual is higher.

US New Home Sales MoM: 0.2% forecast. USD Strengthens if actual is higher.

BoE Gov Bailey Speech: Medium impact expected.

General Verdict:

Source:

https://www.pmi.spglobal.com/public

https://www.pmi.spglobal.com/public

https://www.pmi.spglobal.com/public

https://www.pmi.spglobal.com/public

https://www.pmi.spglobal.com/public

https://www.pmi.spglobal.com/public

https://www.pmi.spglobal.com/public

https://www.pmi.spglobal.com/public

Metatrader MT4