Technical Analysis Post

Citigroup ( NYSE : C ) Q2 Earnings Release: Market Insights, Analyst Forecasts, and Technical Analysis

Citigroup, in a June 26, 2024 announcement, stated that it will disclose its Q2 earnings at around 8 a.m. (ET) today , Friday July 12, 2024. A detailed review of the results will occur via a live webcast and teleconference at 11 a.m. (ET).

Citigroup, in a June 26, 2024 announcement, stated that it will disclose its Q2 earnings at around 8 a.m. (ET) today , Friday July 12, 2024. A detailed review of the results will occur via a live webcast and teleconference at 11 a.m. (ET).

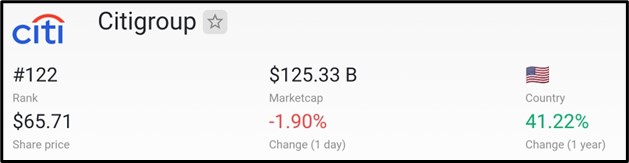

According to data sourced from companiesmarketcap.com as of July 2024, Citigroup commands a market capitalization of $125.33 billion, securing its place as the 122nd highest-ranked company worldwide in terms of market value.

According to data sourced from companiesmarketcap.com as of July 2024, Citigroup commands a market capitalization of $125.33 billion, securing its place as the 122nd highest-ranked company worldwide in terms of market value.

Dividend Information

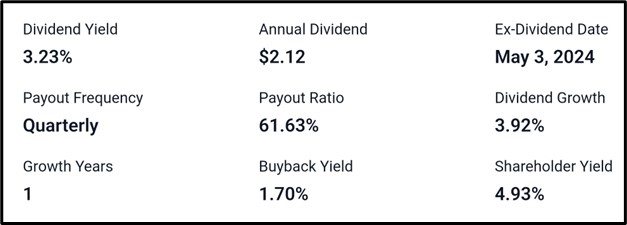

The stock offers a dividend yield of 3.23%, with an annual dividend payout of $2.12 per share. The ex-dividend date was May 3, 2024, and dividends are paid quarterly. The payout ratio stands at 61.63%, reflecting sustainable dividend coverage. The company has shown a dividend growth rate of 3.92% over the past year, supported by a buyback yield contributing to a total shareholder yield of 4.93%.

Recent Development At CitiGroup

Below are CitiGroup’s latest developments:

Ceasing operations in Haiti.

Citi Securities Services awarded an ETF mandate by Nuveen.

Announcement of Stress Capital Buffer requirement.

Launch of Citi Commercial Bank in Japan.

Collaboration with Emirates NBD for 24/7 USD cross-border payments in the Middle East.

Recap of Q1 Earnings Report Release

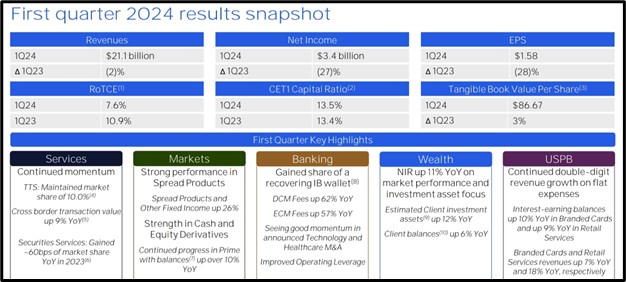

Q1 2024 Earnings Highlights for Citigroup Inc.:

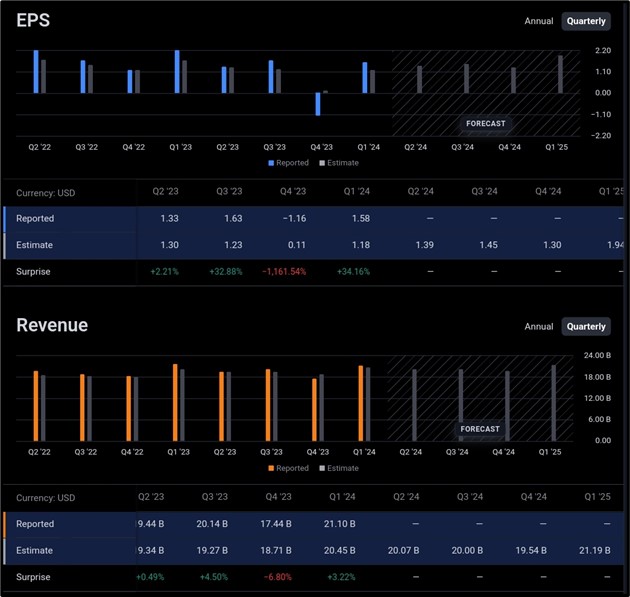

Net income: $3.4 billion, EPS $1.58, on revenues of $21.1 billion, down 2% YoY.

Excluding divestiture impacts, revenues increased 3%, driven by Banking, USPB, and Services growth, partly offset by declines in Markets and Wealth sectors.

Operating Expenses:

Total: $14.2 billion, up 7% YoY.

Adjusted expenses rose 5%, driven by inflation and volume-related costs, with productivity gains.

Cost of Credit:

Approximately $2.4 billion, up from $2.0 billion in Q1 2023, driven by higher card net credit losses despite reduced allowance build.

Financial Performance:

Net income decreased to $3.4 billion from $4.6 billion YoY, impacted by higher expenses, increased cost of credit, and lower revenues.

Steady effective tax rate at 25%.

Financial Position:

Total allowance for credit losses: $21.8 billion.

Loans: $675 billion, up 3% YoY.

Deposits: Approximately $1.3 trillion, down 2% YoY.

Q2 Earnings Report Analyst Forecast

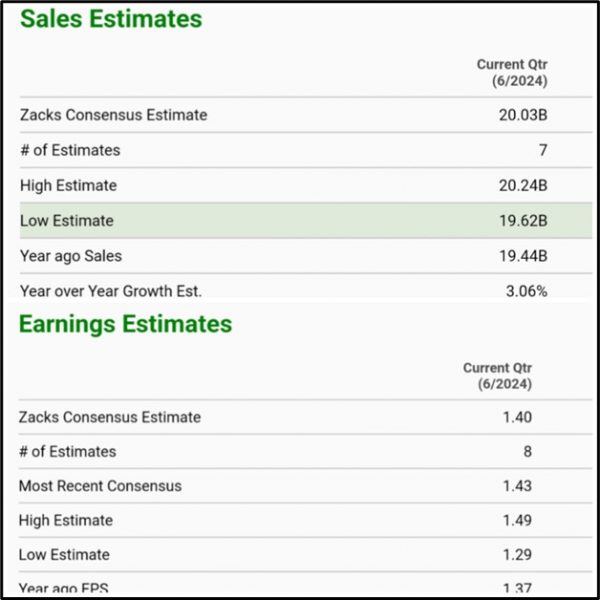

Current Quarter Sales Estimates:

– Zacks Consensus Estimate: $20.03 billion from 7 estimates, with a high of $20.24 billion and a low of $19.62 billion. Year ago sales were $19.44 billion, projecting a 3.06% year-over-year growth.

Current Quarter Earnings Estimates:

– Zacks Consensus Estimate: $1.40 from 8 estimates, with the most recent consensus at $1.43, ranging between a high of $1.49 and a low of $1.29. Year ago EPS was $1.37, indicating a 2.19% year-over-year growth estimate.

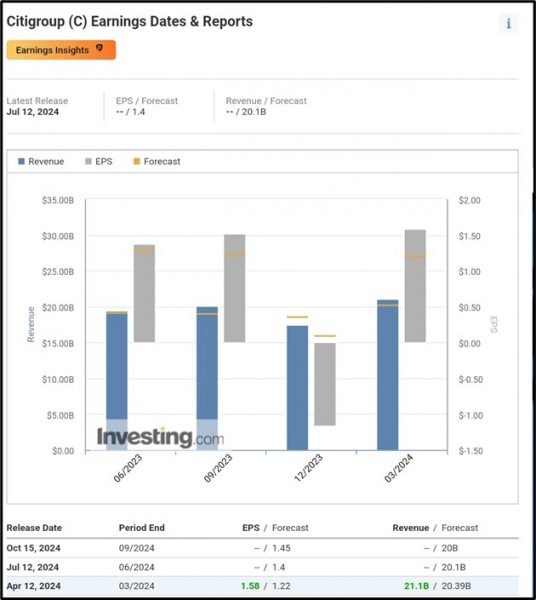

Investing.com forecasts that Citigroup Inc (NYSE: C) will attain an EPS of $1.40 with revenue reaching $20.1 billion.

According to Tradingview.com, Citigroup Inc (NYSE: C) is forecasted to attain an EPS of $1.39 with revenues reaching $20.07 billion.

According to Tradingview.com, Citigroup Inc (NYSE: C) is forecasted to attain an EPS of $1.39 with revenues reaching $20.07 billion.

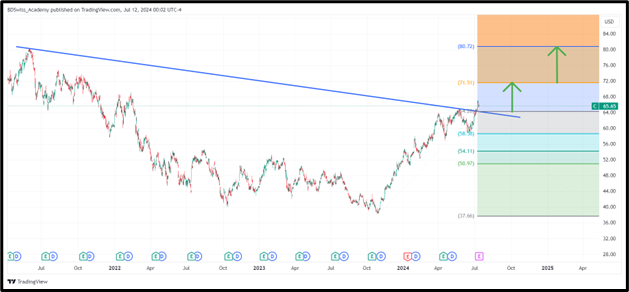

Technical Analysis Q2 Forecast

– Bullish breakout above downtrend line on CitiGroup’s 4hr chart at $64.28 observed on Tradingview.

– Potential target if breakout holds: $71.51; further breakout could lead to $80.72.

– Alternatively, if breakout fails, potential downside to $58.58; further breakdown could target $54.11.

Apply Risk Management

Conclusion

Citigroup’s Q2 2024 earnings release is eagerly anticipated, with analysts forecasting an EPS of $1.40 and revenues around $20.03 billion, reflecting a potential 3.06% year-over-year growth in sales. Despite challenges seen in Q1 2024, including increased operating expenses and higher costs of credit, Citigroup maintains a robust financial position with significant total allowances for credit losses and steady loan growth. Analyst forecasts and technical analysis suggest cautious optimism, with a bullish breakout observed on the charts, indicating potential targets around $71.51 and further to $80.72 if breakout levels hold. Investors are advised to apply prudent risk management strategies in response to these market insights and forecasts.

Sources:

https://www.citigroup.com/global/news/press-release/2024/citi-second-quarter-2024-earnings-call

https://companiesmarketcap.com/citigroup/marketcap/#google_vignette

https://stockanalysis.com/stocks/c/dividend/

https://www.citigroup.com/global/news/press-release/2024/citi-commercial-bank-launches-in-japan

https://images.app.goo.gl/tUmCJkh1MuMjBizT8

https://www.citigroup.com/global/investors/quarterly-earnings

https://www.zacks.com/stock/quote/C/detailed-earning-estimates

https://www.investing.com/equities/citigroup-earnings