Technical Analysis Post

Goldman Sachs ( NYSE : GS ) Q2 Earnings Release: Market Insights, Analyst Forecasts, and Technical Analysis

In a press release on February 16, 2024, The Goldman Sachs Group, Inc. (NYSE: GS) announced it will reveal its Q2 Financial results today, Monday July 15, 2024, at approximately 7:30 am (ET), with details available on its website , https://www.goldmansachs.com/index.html . A public conference call to discuss the financial results and outlook will follow at 9:30 am (ET), accessible via audio webcast through the Investor Relations section , https://www.goldmansachs.com/investor-relations/index.html , of the website.

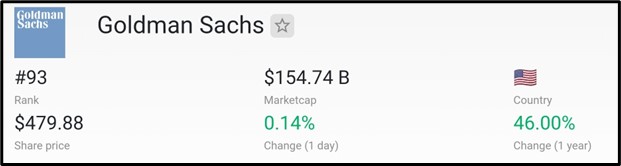

Market Cap

According to data from www.companiesmarketcap.com, as of July 2024, Goldman Sachs, with a market cap of $154.74 billion, ranks as the world’s 93rd most valuable company.

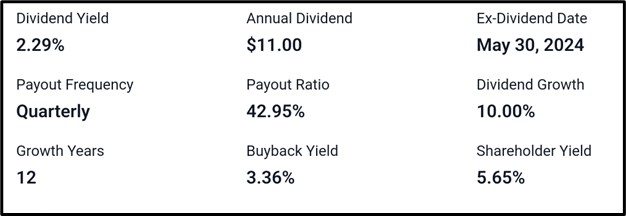

Dividend Information

With a dividend yield of 2.29%, an annual dividend of $11.00, and a quarterly payout frequency, this stock exhibits a 42.95% payout ratio and 10.00% dividend growth rate. Notably, it has achieved 12 years of consecutive dividend growth, with an ex-dividend date of May 30, 2024. Additionally, the stock offers a 3.36% buyback yield and a 5.65% shareholder yield.

Recent Development At Goldman Sach

Here are the latest updates at Goldman Sachs:

Goldman Sachs declares preferred stock dividends.

Launches its first ETF fund in EMEA.

Welcomes John Hess to its board of directors.

Relocates to a new office in Amsterdam.

Marcus by Goldman Sachs Savings ranked #1 in overall customer satisfaction by J.D. Power.

Q1 Earnings Report Recap

– Goldman Sachs (NYSE: GS) reported Q1 2024 net revenues of $14.21 billion and net earnings of $4.13 billion.

– Diluted earnings per share for Q1 2024 were $11.58, up from $8.79 in Q1 2023 and $5.48 in Q4 2023.

– The firm achieved an annualized return on average common shareholders’ equity (ROE) of 14.8% and an annualized return on average tangible common shareholders’ equity (ROTE) of 15.9% for the quarter.

– Global Banking & Markets contributed significantly with $9.73 billion in net revenues, driven by strong performances in Investment Banking fees, Fixed Income, Currency, and Commodities, as well as Equities, which recorded its second highest quarterly net revenues in financing.

– Asset & Wealth Management generated $3.79 billion in net revenues, including record Management and other fees, while assets under supervision reached a record $2.85 trillion.

– Book value per common share increased by 2.4% to $321.10 during the quarter, highlighting Goldman Sachs’ strong financial position and leadership in the market.

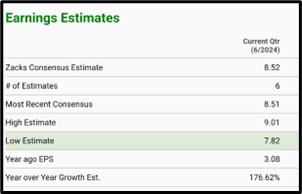

Q2 Earnings Report Analyst Forecast

The Zacks Consensus Estimate for current quarter sales stands at $12.60 billion, based on six analyst estimates, with a high forecast of $12.87 billion and a low of $12.22 billion, reflecting a 15.65% year-over-year growth from last year’s $10.90 billion. On the earnings front, the consensus EPS estimate is $8.52, also derived from six estimates, with the most recent consensus at $8.51. The EPS forecasts range from a high of $9.01 to a low of $7.82, indicating a substantial year-over-year growth of 176.62% compared to last year’s EPS of $3.08.

The Zacks Consensus Estimate for current quarter sales stands at $12.60 billion, based on six analyst estimates, with a high forecast of $12.87 billion and a low of $12.22 billion, reflecting a 15.65% year-over-year growth from last year’s $10.90 billion. On the earnings front, the consensus EPS estimate is $8.52, also derived from six estimates, with the most recent consensus at $8.51. The EPS forecasts range from a high of $9.01 to a low of $7.82, indicating a substantial year-over-year growth of 176.62% compared to last year’s EPS of $3.08.

Investing.com projects Goldman Sachs (NYSE: GS) to achieve an EPS of $8.36 and revenue of $12.35 billion.

Tradingview.com predicts Goldman Sachs (NYSE: GS) will post an EPS of $8.35 and revenue of $12.35 billion.

Tradingview.com predicts Goldman Sachs (NYSE: GS) will post an EPS of $8.35 and revenue of $12.35 billion.

Technical Analysis

– Goldman Sachs resistance breakout identified on 4HR chart at $472.14.

– If breakout sustains, potential price target is $522.42; surpassing this could lead to $586.39.

– If breakout fails, potential downside target is $432.57; breaching this could lead to $401.52.

Apply Risk Management

Conclusion

In conclusion, Goldman Sachs (NYSE: GS) demonstrates a strong financial position with robust Q1 results, including net revenues of $14.21 billion and significant earnings growth. Analyst forecasts for Q2 remain positive, with sales expected to reach $12.60 billion and EPS around $8.52. Technical analysis supports a potential upward price movement. With consistent market leadership and ongoing strategic developments, Goldman Sachs is poised for continued success.

Sources:

https://www.goldmansachs.com/media-relations/press-releases/2024/announcement-02-16-2024.html

https://companiesmarketcap.com/goldman-sachs/marketcap/#google_vignette

https://stockanalysis.com/stocks/gs/dividend/

https://images.app.goo.gl/p5XQkrqPCvsfK29B9

https://www.goldmansachs.com/media-relations/press-releases/2024/2024-04-15-q1-results.html

https://www.zacks.com/stock/quote/GS/detailed-earning-estimates

https://www.investing.com/equities/goldman-sachs-group-earnings

https://www.tradingview.com/symbols/NYSE-GS/forecast/