Technical Analysis Post

Daily Market Report: Expert Technical & Fundamental Insights – 20.03.2025

EURUSD

EURUSD was little changed today, trading at $1.0897. Inflation in EZ fell to 0.4% MoM in February, 2.3% YoY which was weaker than before at 2.4%, that’s good news for ECB. On the other hand, ECB is unlikely to be in hurry to cut the rates, expectations showed that only two more reductions in 2025 will be expected. EZ interest rates stand at 2.65% now. EU leaders summit will be held later today, and ECB’s President Lagarde will deliver speech this morning.

Both, 1H & daily trend index remained bullish, targeting $1.0950. $1.0810 is support. Traders’ sentiments remained bearish in one month forecasts, which was surprising due to EUR’s advance vs USD by 4% in a month. More gains in EUR are likely to be gradual, not aggressive.

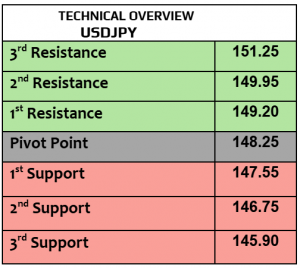

USDJPY

USDJPY traded weaker today & fell to 148.25, one-week low. BoJ kept the interest rates unchanged at 0.5% which was highly expected. Traders will shift the attention to Japan’s inflation numbers later today , it was & still the most important macro numbers for BoJ before any rate decision later. Higher inflation is likely to result in stronger rates by BoJ. After the Fed kept the rates unchanged at 4.5% in yesterday meeting, the yields on US bonds slightly fell to 4.23% on 10Y bonds , further fall in US yields will keep the pressure on USD.

Price action supports further drop to 148.05, backed by bearish daily & weekly trend index.

GBPUSD

GBPUSD slightly fell today to $1.2990, still at the highest level since last November. Big Thursday from the UK with the release of unemployment rate, wages growth, claimant count change & the most will be BoE rate decision as well. While BoE is likely to hold the rates at 4.5%, what matters is BoE monetary policy statement & minutes, not to forget BoE MPC voting as well.

Technically speaking, daily & hourly trend index remained bullish, with divided traders’ forecasts that were 50% for each, bullish & bearish views. $1.2960 is support ( day traders)

Gold

Gold was little changed today, trading at $3046 per ounce, new -record high. Gold kept breaking new record levels, benefiting from weaker USD, consequences of Trump’s tariffs globally, rising the tensions from the ME again, and sticky inflation worldwide. Reducing the rates later this year by the Fed , BoE & ECB may trigger another rally. Gold rose 16% YTD, one of the best starts to years in performance. What’s next ? demand for gold remained robust from the central banks as well.

Traders’ sentiments remained mostly bullish with 67% of the traders and no bearish sentiments. Such a bullish sentiments may support further advance.

Silver

Silver outperformed gold since the beginning of 2025 & gained 17% & 16% for gold. Silver traded slightly weaker today at $33.81 per ounce. Physical transfer of silver from Canada & Mexico to the US may disrupt the global supply of silver as traders wanted to avoid Trump’s tariffs on both countries. The shorter the supply, the higher the price is likely to become.

1H RSI is trading sideways now, volatility remains low. $33.50 is support, $34.25 will be the next resistance. Momentum indicator remained slightly positive.

Oil – WTI

Oil prices remained up by almost 1.5% on weekly basis, trading slightly higher today , WTI $67.33PB, Brent $71.24PB. According to EIA, weekly US crude oil inventories increased by 1.7 million barrels last week, higher than the estimates of 1.1M. What supported oil prices was the rising of the ME tensions again & Israel’s resumption of the war against Hamas. On the other hand, easing the sanctions on Russia oil may increase oil supply, so the traders were mainly cautious & divided . Federal Reserve lowered GDP growth forecasts for 2025.

The target for most of the traders was $66.50 with bearish approach. $66.10 is support, and $68.60 is likely to bet the nest resistance ( target).

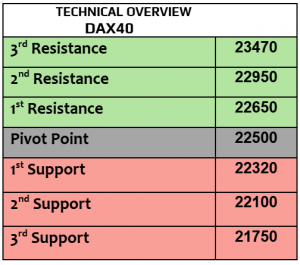

DAX

German DAX index closed lower on Wednesday & fell by -0.4%m DAX futures are showing positive opening. Investors in German equities were mainly driven by the new legislation that will enable Germany’s government to increase the debt limits, reform public borrowing rules & higher spending on defense & infrastructure by almost EUR1 trillion . Germany’s PPI will be due later today. Yesterday, Mercedes fell by -2%, followed by -2.2% in BMW, -1.8% BASF, & Commerzbank lost -3.6%.

Daily trend index remained bullish with positive momentum indicator. 23400 will be the next target. 23000 will be the support for day traders.

Nasdaq

It was positive closing on Wednesday in US stock indexes, Dow Jones 0.92%m SPX 1% & Nasdaq gained 1.4%, all 11 SPX sectors closed higher yesterday, US stock futures traded higher today. Fed chair Powell downplayed the potential impact of tariffs, calling them short-lived which means that the Fed is unlikely to follow Trump’s requests to cut the rates. At the same time, Fed kept the rates unchanged at 4.5% and lowered GDP growth forecasts from 2.1% to 1.7% in 2025, while boosting estimates of US inflation. Keep an eye on the US initial jobless claims, existing home sales & Philadelphia Fred manufacturing survey that will be released later today.

Cautious price action but it is advancing. Both, daily & hourly trend index remained bearish. 19400 is support, 20190 is the resistance.

BTCUSD

Bitcoin traded slightly weaker today at $85800, Eth lost -2% to $2010, followed by -3% loss in XRP, -1% in Solana, and -1.8% in Cardano. According to Ripple CEO, XRP ETFs could launch by second half of 2025. According to many news sources, Pakistan announced its decision to legalize cryptocurrencies, another country is trying to adopt cryptos.

The monthly forecasts remained mostly bearish without bullish bets with average forecast at $77500, however 1 week forecast was much better. Daily & weekly trend index gained the bullish approach again, targeting $86900. $84100 & $82150 are support levels.