Technical Analysis Post

Daily Market Report: Expert Technical & Fundamental Insights – 26.11.2024

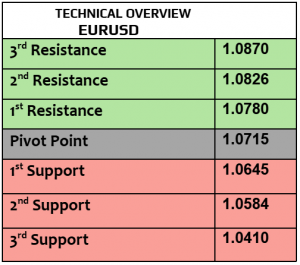

EURUSD

Four consecutive days of losses, EURUSD is trying to recover & trade higher today at $1.0479, not far from the lowest level in two years. As PMI numbers from EZ showed, EZ economy remained fragile & numbers were still below 50, which means that the contraction persisted in service & manufacturing sectors. EZ policy makers & traders are closely watching the US developments & the potential of new tariffs on EZ exports to the US, that’s not what EU leaders want.

Improvement in price action started this morning, heading higher again to $1.0530. Technical channel remained bearish – negative (below the pivot).

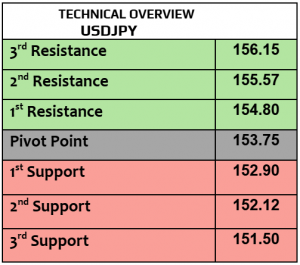

USDJPY

USDJPY continued its falling & traded lower at 153.65, the weakest in two weeks. Correction in USD index started & kept this currency pair under selling mode, while the inflation from Tokyo will be due later this week, the higher the inflation, the higher the probability of increasing the rates in Japan. US bond yields on 10Y bonds fell to 4.29% from 4.40%, that was another important factor to sell USD.

153.90 is support (executed), then 153.50. Volatility is increasing, sending this pair lower to the 1st major support.

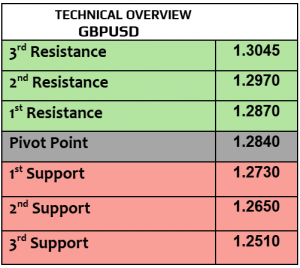

GBPUSD

After falling on a weekly basis, GBPUSD traded slightly higher today at $1.2548, the weakest level since last May. It was very clear that the traders remained anxious about the fragility of the UK economy, not to forget that the UK economy is living in stagflation, worse than other advanced economies. The next step by BoE may keep the rates unchanged, not to cut it further as many estimates showed before.

The daily chart is not promising for market bulls. 1H chart is slightly increasing to $1.26, $1.2510 is a major support. Volatility is low.

Gold

Gold is trying to recover & trade higher today at $2624 per ounce after it lost on Monday, the biggest daily loss in more than a year, it dropped -3.4% on Monday. FOMC minutes later today will be important as it will reveal the policy outlook, dovish stance by the Fed members (if any) is likely to be bullish on gold. All eyes remained on Trump’s new nomination for US Treasury Department.

Even if 1H RSI is at support level now (30), price action is not showing bullish bets. $2600 is the next target. $2639 will be resistance (day-traders). As long as gold maintains $2550 then it may rebound again.

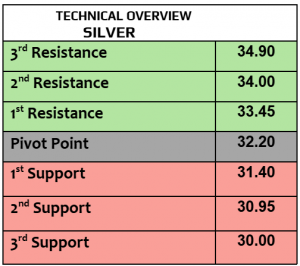

Silver

Similar to the trend of gold, silver traded higher today at $30.34 per ounce, after it lost -3% on Monday. Silver is likely to remain highly exposed to Trump’s new tariffs, not only on China but on Canada & Mexico as well. Mexico is the World’s biggest silver producer by 6400 tonnes, almost 25% of the total global production, followed by China 13.2% and Peru 12%.

1H RSI is recovering, heading higher again to $30.65 . $30 remains a major support.

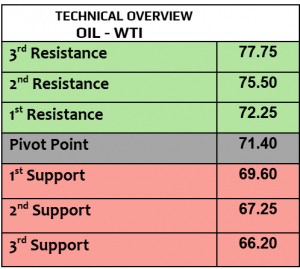

Oil – WTI

Two consecutive days of loss, oil prices traded slightly higher today, WTI $69.28PB, Brent $73.37PB, losing more than -3% on Monday due to the potential of ceasefire agreement between Israel & Lebanon. In the meantime, API will release the US weekly crude oil inventories later today, OPEC next meeting will on December 1st.

Price action supports further increase to $69.90 then $70.50. 1H RSI is trading at re-entry level with stronger bullish bets than bearish ones.

DAX

German DAX futures traded weaker today after it closed higher by 0.4% on Monday. Yesterday’s gains have been supported by 1.8% in Siemens, 2.2% BMW, 1% Mercedes & 2.7% in Porsche. Commerzbank dropped by -5% as Italian bank UniCredit announced a bid to acquire Banco BPM, UniCredit owns over 20% in Commerzbank.

Price action and markets’ sentiments remained somehow mixed. 19290 is resistance (executed) then 19500. 19120 is support, 1H RSI is still heading higher.

Nasdaq

US stock futures were mixed today. Yesterday, Dow Jones gained 1%, new record-high, SPX 0.3% & Nasdaq 0.27%. The rally was fueled by optimism after Trump announced Scott Bessent as Treasury Secretary, Scott was a hedge fund manager, and likely to adopt market-friendly policies. FOMC minutes will be released later today, revealing the Fed policy outlook & expectations. US new homes sales & consumer confidence will be due today as well.

Price action kept improving, heading higher to 20750 (executed) then 20900. 20400 & 20300 are support for day-traders.

BTCUSD

Major crypto currencies traded higher today, BTC $94850, Eth $3435, Ripple $1.44 & Cardano $0.9811. Bitcoin fell yesterday by almost 5%, however the trend has not yet changed. More global adoption & higher mass users are crucial to keep the trend bullish.

Price action showed no appetite for huge profit taking, still heading higher to new record at $100K. $96600 is support (already executed) then $92K. Aggressive volatility remained intact.